What do you want to achieve?

According to Deloitte, "well-executed hyper-personalization can deliver 8x the return on investment and lift sales by 10% or more."

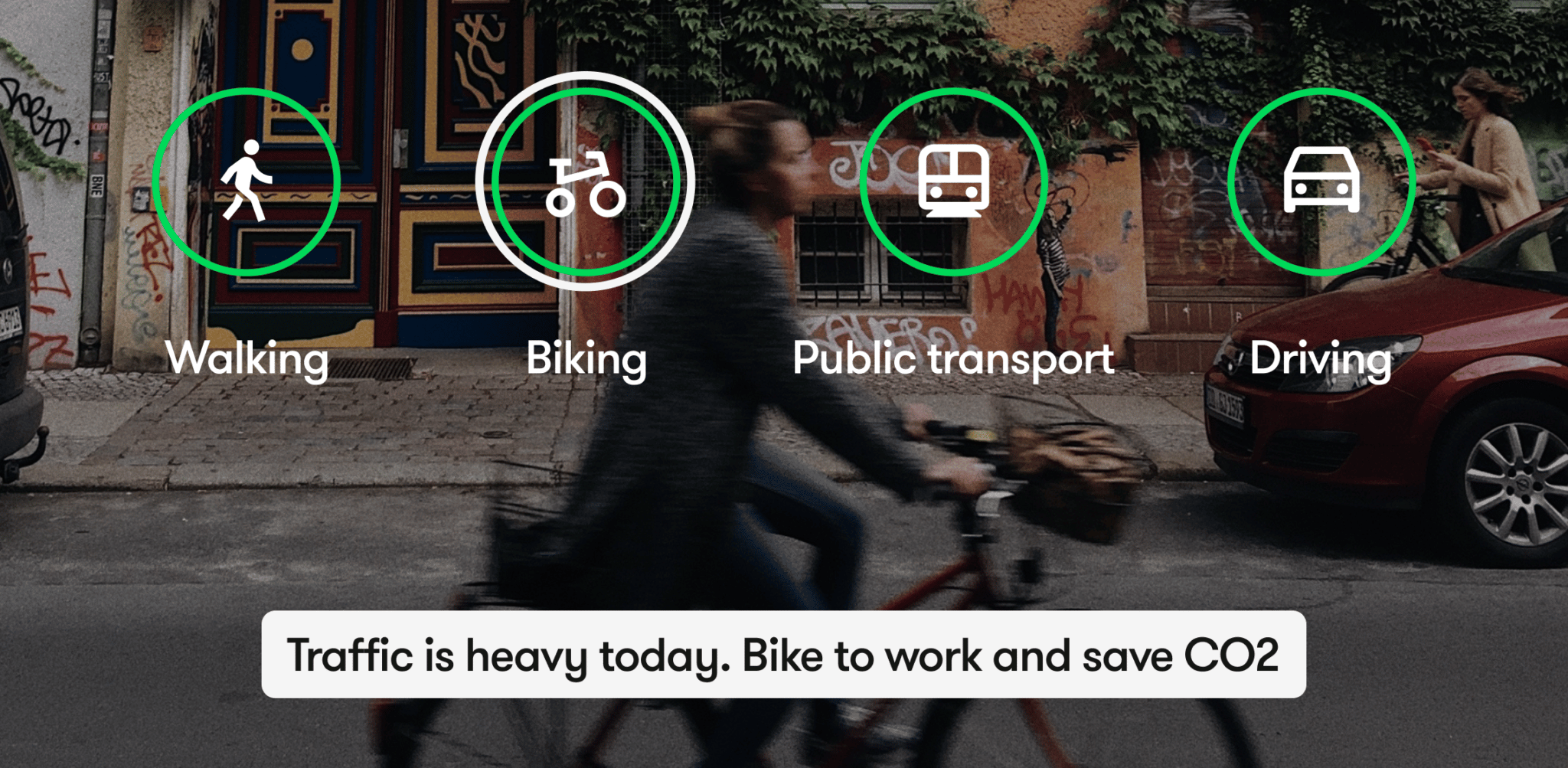

With Mobility Insights, knowing if your app users are green commuters, public transport users, or die-hard drivers (for instance), will allow you to hyper-personalize your offerings.

Let's face it: today's customers expect real-time personalization.

Distracted driving is one of the top causes of car accidents. On average, distracted driving costs 3,142 lives per year in the US alone. Surprisingly 34% of surveyed drivers believe it's very safe to hold your phone while driving (Nationwide).

With Sentiance’s Driving Insights, you can detect distracted driving behavior, among many other things. Furthermore, our behavioral scientists design digital driver coaching programs to improve driver safety on the road.

Sadly, over 150 people were killed on Western Australian (WA) roads in 2020 and distracted driving was a factor in ~13% of those crashes.

"Studying what people did is outdated, understanding why people do what they do is the future. And those insights can provide an organization with a compass for the future." — Accenture

Sentiance's Mobility Insights and Lifestyle Insights help you take user experience and engagement to the next level.

Only by understanding your users, you can create a meaningful impact in their lives.

Taking advantage of our evolved Driving Insights, usage-based insurance finally makes sense. Our mobile telematics technology is used by key insurers to guarantee their offerings are as personalized as possible.

Focusing on prevention, our partners use our technology to significantly increase their profit margins without decreasing the user experience.

In fact, our Engagement features are designed to hyper-personalize your offerings and increase customer loyalty.

Police reports can take up to 6 months. Sending someone to the scene of the investigation can cost you up to $10k. Often, each claims adjuster has around 50 open claims to process. In addition, the claims assessment process usually takes between 4-6 weeks.

We feel you. By losing time, you are decreasing your revenue.

Driving Insights help you reduce friction in the claims process, making it 4x faster by better understanding your customers.

Crash Detection & Reporting accurately detects crashes in real time and obtains advanced insights from them.

High-risk drivers are problematic for themselves, those around them, and insurers. Most auto and life insurance companies would say an “average” or “good” loss ratio is between 40-60%. If you reached this part, you already know high-risk customers result in higher loss ratios. Hence, you also understand the importance of risk profiling.

Understand your users with Driving and Lifestyle Insights. Coach them to become better drivers and promote healthier lifestyles with our Engagement features. Instead of settling on average loss ratios, focus on prevention and increase your margins.

In 2015, the United Nations set out 17 Sustainable Development Goals (SDGs) for 2030. We can help you track, measure, and reduce the mobility CO2 footprint of your business.

Sentiance will help you in the transformation to a sustainable and inclusive society.

Understand your customers' real world mobility profile with Sentiance’s Mobility Insights and hyper personalize your products with our Engagement features.

By leveraging our technology, you will be able to help change your users' behavior and mobility patterns towards a more sustainable lifestyle.

They significantly reduced the CO2 footprint of their business.

Did you know in the US alone, $8 billion (around 17%) of the claims payments are fraudulent?

We help our partners uncover the real story, get in-depth analysis, and reduce fraudulent claims.

Use our Driving and Lifestyle Insights to detect car crashes, get in-depth information from users' trips, driving events, precise location... and all other necessary insights to enhance fraud detection, save time and worry less.

World-leading companies trust us with our road safety vision.

Now, it's your turn.

Let's build a safer future together!

Sentiance is the leader in motion insights. Our mission is to save lives every day and shape the future of road safety. Unlike telematics companies, we focus on the driver and not the vehicle because most accidents are caused by human error.

With our revolutionary on-device AI technology, companies use insights from The Edge Platform to produce scalable, cost-efficient, and privacy-centric solutions for their customers.

Developed with the support of

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |